Plan for Reimbursement of Attorney Fees and Expenses in Civil Cases

- Overview of the Program

It is the policy of this Court to encourage members of the bar to represent parties who cannot afford counsel. To further this policy, the Court adopts this Plan for Reimbursement of Attorney Fees and Expenses in Civil Cases (“Plan”) and the attached Appointment of Pro Bono Counsel Reimbursement form (“PBP 20”) for use in appointing counsel under this Plan.

When an attorney has been appointed to represent an indigent party in a civil matter, that attorney will be allowed to petition the Court for fees and reimbursement of certain expenses. Fees and expenses must be incurred in the preparation and presentation of the case. The maximum amount that may be reimbursed for all expenses in a case is $3,500, and the maximum amount that may be paid for all fees in a case is $1,000. The Non-Appropriated Fund Committee has the authority to grant exceptions to the maximums established for fees and expenses. Funding for this program comes from this Court’s Non-Appropriated Fund.

- Restrictions

- Any fees and expenses that are either waived or recoverable under the provisions of Title 18, U.S.C. or Title 28, U.S.C. or that have been recovered under any other plan of reimbursement may not be reimbursed from the Non-Appropriated Fund.

- An attorney appointed to a case under this Plan who has been awarded fees and/or expenses in the case is not eligible for fees and/or reimbursement of expenses from the Non-Appropriated Fund.

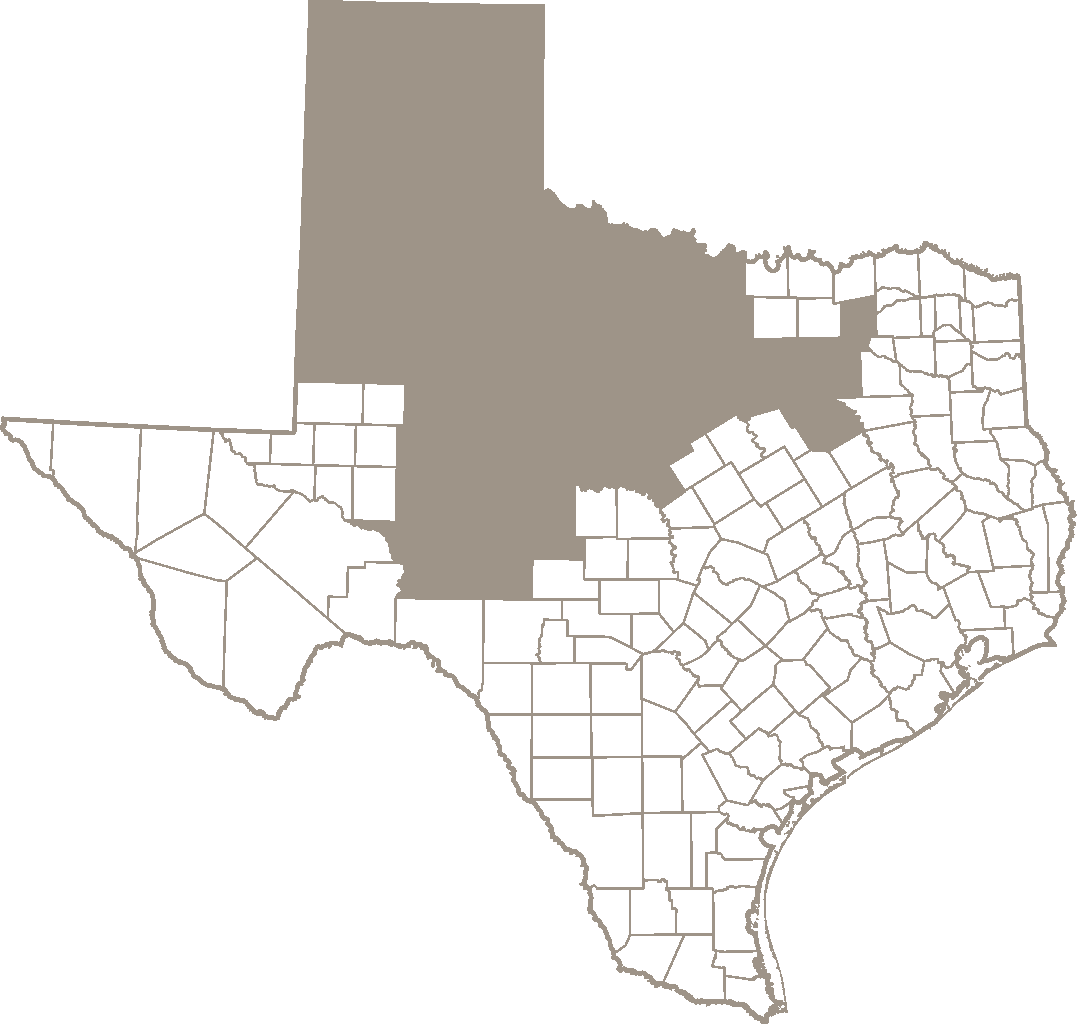

- Only those fees and expenses associated with the preparation or presentation of a civil action in the United States District Court for the Northern District of Texas may be approved for payment. No fees or expenses associated with the preparation or presentation of an appeal to the U.S. Court of Appeals or the U.S. Supreme Court will be reimbursed from the Non-Appropriated Fund.

- Procedure for Requesting Fees and/or Expenses

All requests for fees and/or reimbursement of expenses in civil cases must be filed within thirty days of the entry of judgment. No interim payments will be made.

The appointed attorney must file with the Clerk's Office a request for fees and/or reimbursement of expenses on a PBP 20 form that has been approved and signed by the presiding judge. The form must be accompanied by an itemized statement and receipts to substantiate the request. The clerk will forward the PBP 20 form and attachments to the Non-Appropriated Fund Committee Chairperson for final approval.

If an appointed attorney has withdrawn or has been dismissed prior to the entry of judgment, that attorney must file a request for fees and/or expenses within thirty days of withdrawal or dismissal. Any work product or services for which reimbursement is requested from the Non-Appropriated Fund must subsequently be provided to newly-appointed counsel or, if no new counsel is appointed, to the party.

- Allowable Expenses

Appointed attorneys may request reimbursement under this Plan for the following expenses:

- Depositions and Transcripts

Appointed counsel may order transcripts or depositions necessary in the preparation of the case. The cost of such transcripts may not exceed the page rate for ordinary copy established in the Northern District of Texas. Only the cost of one original of any transcript will be allowed; the cost of additional copies will not be reimbursed. In the interest of efficiency and cost-effectiveness, appointed attorneys are encouraged to use audiotapes for depositions. If audiotape depositions are used, transcription of the depositions may be reimbursed at the ordinary page rate established in the Northern District of Texas.

- Investigative or Expert Services

Counsel may request investigative or expert services necessary for the adequate preparation of a matter. Such services must have prior court approval by the judge to whom the case is assigned to be approved for reimbursement.

Approval for investigative or expert services is not automatic. Therefore, attorneys should be prepared to explain why the services are necessary.

- Travel Expenses

Travel by privately-owned car for trips in excess of thirty miles (each way) may be claimed at the current mileage rate authorized for federal employees. In addition, out-of-pocket expenses for parking may also be reimbursed.

- Fees for Service of Process

Fees for service of papers and the appearance of witnesses not otherwise voided, waived or recovered may be reimbursed.

- Interpreter Services

Costs of interpreter services not otherwise voided, waived, or recoverable may be reimbursed.

- Photocopying, Telephone Calls, etc.

Actual expenses incurred for such items as photocopying, photographs used in the case, toll calls, and the like may be reimbursed. Such expenses must be unavoidable in preparation of the case.

- Depositions and Transcripts

- Non-Allowable Expenses

The following expenses will not be reimbursed under this Plan:

- General office expenses, including office overhead, payroll costs, equipment depreciation, basic telephone service, and the like will not be reimbursable under this Plan.

- Any expense not properly documented with receipts or other proof may be disallowed by the judge or the Non-Appropriated Fund Committee.

- Expenses that may be statutorily recovered or costs or fees taxed against a party or appointed counsel will not be reimbursed by this Plan.